Want to pocket more money for college?

While preparing your 2014 Utah state income tax returns, consider sending your state income tax refund directly to your Utah Educational Savings Plan (UESP) account. Your refund will be applied equally among accounts owned by you and, if you file taxes jointly, your spouse.

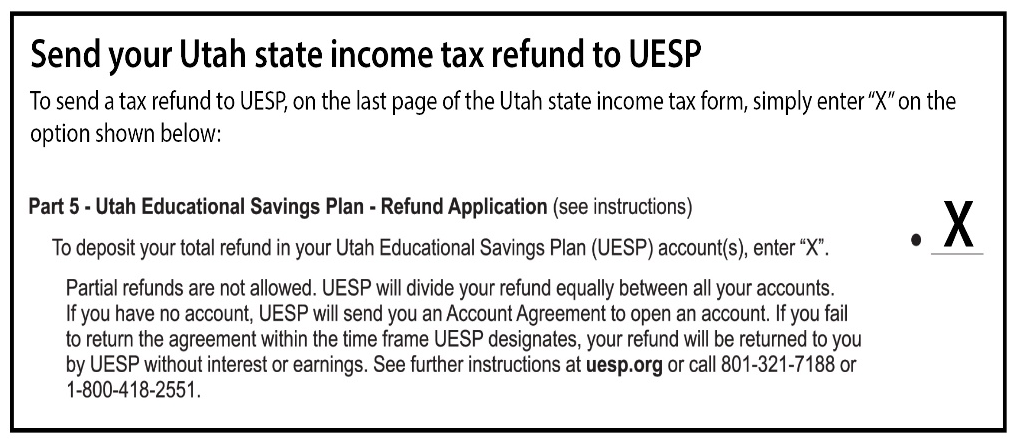

On the last page of your Utah state income tax form, simply enter “X” on the option shown below:

If you don’t already own an account, it’s easy to open one online at uesp.org. As Utah’s official 529 college savings plan, UESP offers tax advantages when you invest for college. Earnings on contributions grow tax-deferred, and you pay no federal or Utah state income taxes on withdrawals if you use the money to pay for qualified higher education expenses, including tuition and fees; books, supplies, and required equipment; and certain room-and-board costs.

Utah resident account owners also are eligible for a Utah state income tax credit on contributions to their UESP accounts. For the 2015 tax year, you can claim a 5 percent Utah state income tax credit for eligible contributions up to $1,900 ($95 maximum tax credit) per qualified beneficiary. Joint filers can claim the credit on contributions up to $3,800 ($190 maximum credit) per qualified beneficiary.

In order for an account owner to claim the tax credit, the beneficiary must have been age 19 or younger when designated as such on the account. If this requirement is met, the account owner can claim the credit each year a contribution is made for the life of the beneficiary’s account.

For more information, call UESP toll-free at 800.418.2551, or email info@uesp.org.

Important Legal Notice

The Utah Educational Savings Plan (UESP) is a Section 529 plan administered and managed by the Utah State Board of Regents and the Utah Higher Education Assistance Authority (UHEAA).

Read the Program Description for more information and consider all investment objectives, risks, charges, and expenses before investing. Call 800.418.2551 for a copy of the Program Description or visit uesp.org.

Investments are not guaranteed by UESP, the Utah State Board of Regents, UHEAA, or any other state or federal agency. However, Federal Deposit Insurance Corporation (FDIC) insurance is provided for the FDIC-insured accounts. Please read the Program Description to learn about the FDIC-insured accounts. Your investment could lose value.

Non-Utah taxpayers and residents: You should determine whether the state in which you or your beneficiary pays taxes or lives offers a 529 plan that provides state tax or other benefits not otherwise available to you by investing in UESP. You should consider such state tax treatment and benefits, if any, before investing in UESP.